TokenSmart NFT Humpday Report #8: The Crypto Bulls Are Back 🐂🐂🐂

Welcome to the 8th issue of the NFT Humpday Report, a weekly column providing embedded analysis on the NFT economy’s biggest topics du jour. Brought to you by WIP meetup collaborators and nft42 community hub TokenSmart.

Cryptoeconomy users are buzzing this week after bitcoin (BTC) reached the +$18k USD price mark for the first time since late 2017 and a new all-time high market cap of +$3.3B. Buy pressure pushed ether (ETH) past $485, too — a price the second-largest crypto notably hasn’t seen since July 2018.

Source: Coinbase

Why it matters: After a multi-year bear market, it looks like the bulls may be decisively returning to crypto’s risk-on markets once more.

But while the 2017 bull market was dominated by retail investors, recent crypto embraces in the mainstream (e.g. PayPal’s new services) combined with Google search trends suggest it’s not consumers but rather large firms driving the cryptoeconomy’s current rally. That means if retail investors return and join institutions in this cycle, the next bull market may totally dwarf the last one.

By the numbers:

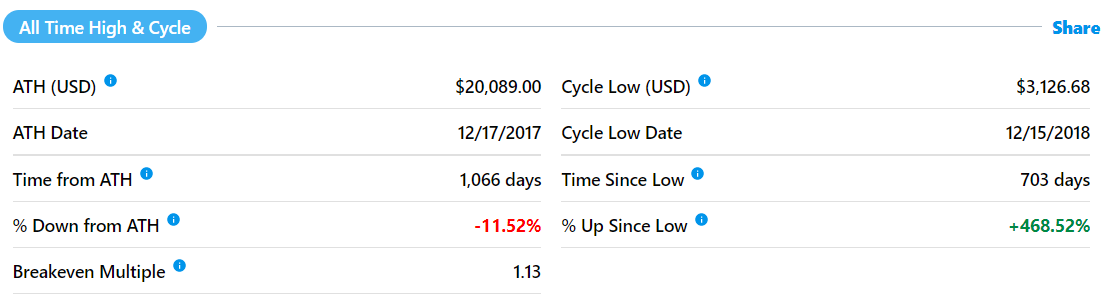

Presently trading near $18k, BTC is just a little over 10% shy of its standing Dec. 2017 price record of +$20,000 according to Messari. Over the last two years, the OG crypto is up nearly 500% from its cycle low of ~$3,127 as well.

ETH is the asset currently at the heart of booming decentralized finance (DeFi) and non-fungible token (NFT) ecosystems, so another big thread to watch right now is ETH’s acute price run. ETH is currently trading at $487 and in stride with BTC is up 500% from its Dec. 2018 cycle low of $81.

A rising tide lifts all wallets: Many DeFi and NFT projects respectively maintain treasuries that have large crypto reserves. When the prices of these assets rise, these projects have more spending power that they can put into their operations and development efforts.

The same is true for individual NFT creators: the higher the ETH price, the more they can receive when they cash out or trade through their exchanges of choice. The takeaway? A bullish crypto market is good for builders and innovators.

Boon for the NFT economy: The NFT sector has considerably bloomed since 2017 and, on account of organically climbing in the cryptoeconomy’s limelight in recent months, is positioned to capture swathes of new users if cryptocurrencies really catch fire once again.

Be safe: Scammers and blackhats always start paying more attention when crypto markets heat up.

If crypto prices continue to rip skyward from here, expect an acute influx of malicious actors to come poking around looking for chances to separate victims from their crypto and/or NFTs. As a potential target for these folks, you’ll want to take extra precautions accordingly.

Triple check the links you click on + the addresses you send to.

Buy a hardware wallet to mitigate hot wallet attacks, e.g. a hacker using a keylogger to scrape your MetaMask password.

If someone’s offering you a crypto-centric deal that sounds too good to be true, it is.

Be cautious with DeFi protocols, and never put in more than you can afford to lose. Some are battle-tested, but newer ones are being probed for flaws as we speak.

Don’t act on false information — look to projects’ official pages and social media accounts for accurate updates.

Watch out for counterfeit NFTs on do-it-yourself (DIY) NFT marketplaces; research and confirm a piece’s provenance before purchasing it!

Thanks for reading the 8th NFT Humpday Report! Check back this time next week for more excellent NFT ecosystem coverage! Cheers🌠