Welcome to the 15th issue of the NFT Humpday Report, a weekly column covering and providing embedded analysis on the NFT economy’s biggest topics du jour. Brought to you by WIP meetup collaborators and nft42 community hub TokenSmart.

This week an $800k NFT transaction turned heads and raised eyebrows, with some hailing the purchase as the NFT ecosystem’s new highest NFT sales record and others expressing doubt that the high-profile purchase was, in fact, organic.

Source: OpenSea

Context: Previously, the standing single-sale NFT sales record was $777k as set by acclaimed everydays artist beeple and his “The Complete MF Collection” auction last year. That apparently changed this week when blockchain gaming project Gala Games sold Citadel of the Sun, a legendary asset in Gala’s upcoming MMORPG game World of Mirandus, for 800k USDC on OpenSea to NFT-focused investment firm Polyient Games. Polyient Games had invested into Gala Games previously, so the firm is an open believer and backer of the upcoming franchise. That said, the whopping 800k price tag around a virtually unknown project was beyond the pale for some NFT stalwarts who concluded the sale seemed like a case of publicity-minded shill bidding rather than honest bidding.

Going deeper: In the future, Polyient Games will use its decentralized exchange (DEX) and vault services to effectively become the banking system of World of Mirandus. As such, it’s clear Polyient Games is betting big on the franchise in general and intends to be a big stakeholder in its ecosystem going forward. The grand question then is whether this was a clear-cut investment based on embedded insights or more of a publicity stunt after all.

Why it matters: Shill bidding, where it does in fact occur, throws valuations around the NFT ecosystem into question via artificial pricings. This can lead to honest bidders paying higher prices than they would have otherwise had to, which is a disservice to collectors and users. A way of cutting corners, shill bidding raises the profile of projects that didn’t organically earn interest and that are willing to take advantage of their stakeholders.

This phenomenon isn’t unique to the NFT ecosystem, either, as it happens and is fought against around mainstream markets like eBay, too. The newness and pseudonymity of blockchains like Ethereum has simply opened up new horizons for such bids and the problems of unfairness that they pose.

Consider the incentives: There’s more upside to shill bidding (e.g. gaining interest, activity) than drawbacks, especially if the bidding is done discreetly. As long as this dynamic remains the case, shill bidding will be an inescapable reality around NFT markets.

Digging into the archives: This isn’t the first time we’ve arguably seen this kind of behavior in the NFT ecosystem.

Another possible example from recent memory was the May 2019 auction around F1 Delta Time’s first collectible racecar, the 1-1-1.

The eventual winner of the NFT was Metakovan, who purchased the virtual car for over 415 ETH (~$110k USD at the time). Metakovan’s impressive and impassioned track record of NFT collecting speaks for itself, so there’s no reason to think their +415 ETH purchase of 1-1-1 was anything but honest bidding. Metakovan’s even been interviewed on the buy, where they emphatically suggested they viewed 1-1-1 as basically priceless (“There's something special about that 'first' car. Like being able to own the first ever Ford Model A.”)

Where things get murkier, though, is some of the prior bids on 1-1-1. For instance, at one point two users - robertwhite and DWM per OpenSea - were apparently in a bidding war for the NFT.

The problem? Both of these accounts had little activity before or after the 1-1-1 auction and both had the same original funding source, this 0xf1c address.

See above: The 0xf1c address, owner unknown, funded robertwhite’s 0x3a9 address through an intermediary address just days ahead of the 1-1-1 auction.

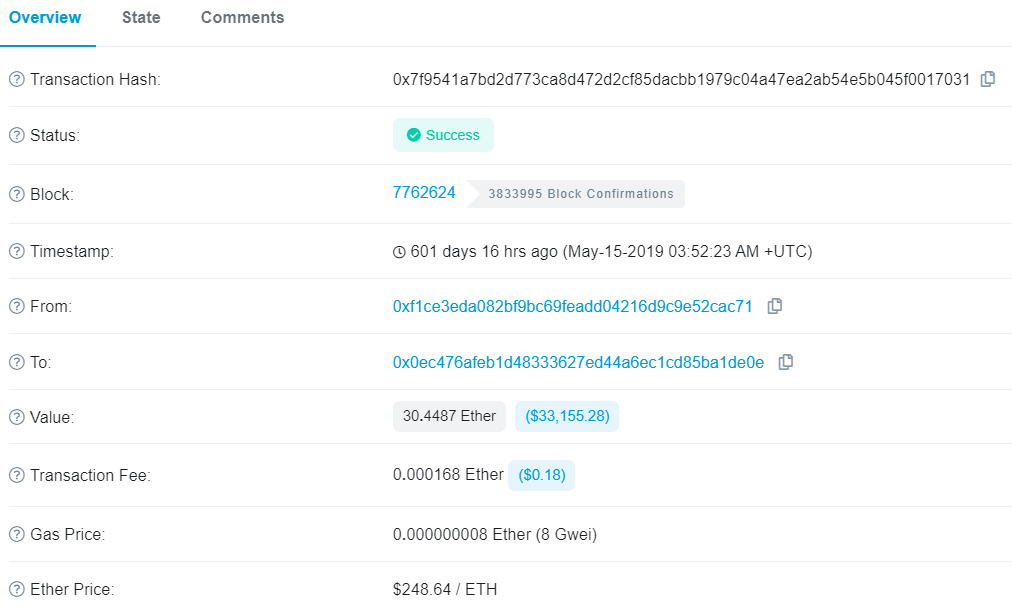

See below: The 0xf1c address directly funded DWM’s 0x0ec address days ahead of the 1-1-1 auction.

In the very least, then, it looks like 1-1-1 bidders robertwhite and DWM were directly connected and even coordinating to artificially drive up the NFT’s price, i.e. shill bidding. It’s not clear what the full picture is here, as who’s behind these accounts remains unknown. But these addresses are seemingly case study material for artificial manipulation around NFT auctions going forward.

The takeaway: Any project accused of shill bidding should be presumed innocent until proven guilty, and this analysis isn’t alleging wrongdoing on any of the aforementioned parties’ parts. Rather it’s an exploration of how we can’t take everything at face value in the nascent NFT ecosystem, where in many ways shill bidding can go unchecked. There’s no easy way to resolutely tackle this problem for now, so in the meantime good faith NFT users have to be vigilant and not shy from due diligence via on-chain analysis.

Thanks for reading the 15th NFT Humpday Report! Check back this time next week for more excellent NFT ecosystem coverage! Cheers🌠

Do the research, this is lazy writing. There is a medium article published by the seller that this was private agreement that was consummated in a public forum for transparency, there was no shill bidding or bidding at all.